Petro-Victory Energy Corp. Provides Operations Update

CALGARY, AB, Sept. 5, 2024 /PRNewswire/ - Petro-Victory Energy Corp. ("Petro-Victory" or the "Company" or "PVE") (TSXV: VRY) provides an operations update to the shareholders.

2024 Advancement Highlights:

- São João Field, 3-well, workover campaign was completed in April 2024, total oil sales volumes for the three months ended June 30, 2024 was 5,814 bbls up 99% from prior quarter.

- Best Estimate - Development Pending Risked Contingent Gas Resources located at the São João Field added 50.1 billion cubic feet (1.4 billion cubic meters) of gas or 8.4 million barrels of oil equivalent ("MMboe") and NPV10 USD $97.3 million.

- The Company updated its reserve report with 6.9 MMboe and NPV10 USD $257.7 million ($40.05/boe) 2P reserves.

- The Company announced a partnership with Azevedo Travassos Petróleo S/A ("ATP") to develop the Andorinha field and Block 281.

Partnership with Azevedo Travassos Petróleo

Block 281: Petro-Victory will re-enter and perform a workover on the CR-2 well in Block 281. The workover will commence in October as part of the ATP Partnership. ATP will pay 100% of the workover program and recover the cost through the net income generated by the production of the CR-2 well: 75 percent ATP and 25 percent PVE, after which, the two companies will split the net income generated by the production 50/50.

Andorinha Field: Petro-Victory will drill two additional in-field wells at the Andorinha field beginning in December through the ATP Partnership, ATP will pay 100% of the drilling work program and recover cost through the net income generated by the production of the two wells: 75 percent ATP and 25 percent PVE, after which, the two companies will split the net income generated by the production 50/50.

Commercial Outlook: Upon the completion of and based on the results of the CR-2 workover and the Andorinha drilling program, a new reserve report will be obtained, and ATP will have the option to purchase 50% ownership in the Andorinha field and Block 281 at a price of USD $10 per proven barrel and USD $4 per probable barrel. The option to purchase must be exercised within nine months following the completion of the work program.

High Impact Exploration:

Drilling Prospects: Six additional high-impact exploration drilling prospects have received environmental and drilling licenses. A new prospective resource report will be completed in September. The Company is carefully evaluating all options for financing the high-impact exploration drilling prospects including but not limited to strategic partnerships or equity investments.

Acquisition of Mature Fields:

Collaboration with international group: In August, Petro-Victory entered into an MOU ("Memorandum of understanding") Collaboration with XP Group, an international oil and gas operator, to evaluate, acquire, and enhance production in mature oil and gas fields in Latin America. This collaboration further strengthens Petro-Victory's position to increase production through the acquisition of mature producing fields across Latin America.

Message to shareholders

Richard F. Gonzalez, CEO of Petro-Victory Energy Corp. commented: "With the completion of the three-well workover program at the São João Field, total oil sales volumes for the three months ended June 30, 2024 was 5,814 bbls, an increase of 99% over the first quarter 2024 sales volumes. The São João Field had no production, no reserve report, and no facilities prior to Petro-Victory entering in April 2020. The field has since produced more than 50,000 barrels of oil and has 1.9 MMboe in 2P Reserves and Best Estimate - Development Pending Risked Contingent Gas Resources of 8.4 MMboe.

"Consolidated production from the São João, Andorinha, and Trapiá fields during the second quarter averaged 64 barrels of oil per day (bopd) and generated an average of USD $144 thousand in oil revenues per month with an average netback per month in the quarter of USD $72 thousand or USD $37.08 per barrel representing a 50% margin. In July and August we have averaged 48 bopd.

"Production growth continues to be a priority for Petro-Victory and future production volumes are expected to increase disproportionately from production expense as the Company executes on the development plan in the second half 2024 and beyond, thus decreasing the production cost per barrel and increasing operating netback margins.

"The Company has focused on establishing strategic partnerships and joint ventures during the period with an emphasis on monetizing existing assets and reserves.

"The ATP partnership is progressing exceptionally well. The teams' combined experience and expertise are highly complementary. The synergies not only enhance our current projects but also opens up numerous opportunities for future growth. By leveraging our collective strengths, we can operate more effectively and drive greater value for both organizations.

"Furthermore, the Company is also evaluating opportunities to increase production through the acquisition of mature fields in Brazil and LATAM which would be complementary to our existing high-growth portfolio."

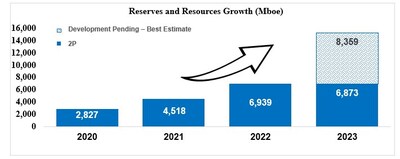

Summary Reserves and Resources

As announced in the press release dated May 9, 2024, the Company's Independent Reserve and Resource Report as of December 31, 2023 and issued by GLJ, Ltd. dated April 25, 2024 ("GLJ Report") added development pending risked contingent resources of 8.4 MMboe. The GLJ Report is summarized below.

The Company holds 100% working interest in thirty-eight (38) concessions. Six (6) of the thirty-eight (38) concessions have reserves included in the GLJ Report. The Company continues to invest geological and geophysical resources in further evaluation of the remaining thirty-two (32) blocks. The additional thirty-two (32) concession blocks are not included in the reserve figures below.

- Proved ("1P") reserves:

- 3,434 thousand barrels of oil equivalent ("Mboe"); and

- Net present value before tax, discounted at 10% ("NPV10") is USD $130.5 million ($40.68/boe) for 1P reserves.

- Proved plus Probable ("2P") reserves:

- 6,873 Mboe; and

- Before tax NPV10 is USD $257.7 million ($40.05/boe) for 2P reserves.

- Proved plus Probable plus Possible ("3P") reserves:

- 10,116 Mboe; and

- Before tax NPV10 is USD $368.5 million ($38.91/boe) for 3P reserves.

- Development Pending Risked Contingent Resources – Best Estimate

- 8,359 Mboe; and

- Before tax NPV10 is USD $97.3 million

Furthermore, the Company has identified 16 opportunities across 12 of the other blocks. Of these, 7 opportunities represent economically viable prospects. The Company will have a prospective resources report completed in the coming weeks for the first four (4) initial prospects.

About Petro Victory Energy Corp.

Petro Victory Energy Corp. is engaged in the acquisition, development, and production of crude oil and natural gas resources in Brazil. The company holds 100% operating and working interests in thirty-eight (38) licenses totaling 257,604 acres in two (2) different producing basins in Brazil. Petro-Victory generates accretive shareholder value through disciplined investments in high-impact, low-risk assets. The Company's Common Shares trade on the TSXV under the ticker symbol VRY.

Cautionary Note

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

This press release does not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of these securities, in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act"), or any state securities laws and may not be offered or sold within the United States unless an exemption from such registration is available.

Advisory Regarding Forward-Looking Statements

In the interest of providing Petro Victory's shareholders and potential investors with information regarding Petro Victory's future plans and operations, certain statements in this press release are "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward-looking information" within the meaning of applicable Canadian securities legislation (collectively, "forward-looking statements"). In some cases, forward-looking statements can be identified by terminology such as "anticipate," "believe," "continue," "could," "estimate," "expect," "forecast," "intend," "may," "objective," "ongoing," "outlook," "potential," "project," "plan," "should," "target," "would," "will" or similar words suggesting future outcomes, events or performance. The forward-looking statements contained in this press release speak only as of the date thereof and are expressly qualified by this cautionary statement.

Specifically, this press release contains forward-looking statements relating to, but not limited to, our business strategies, plans and objectives, and drilling, testing, and exploration expectations. These forward-looking statements are based on certain key assumptions regarding, among other things, our ability to add production and reserves through our exploration activities; the receipt, in a timely manner, of regulatory and other required approvals for our operating activities; the approval by the TSXV of the Market Maker Agreement; the availability and cost of labor and other industry services; the continuance of existing and, in certain circumstances, proposed tax and royalty regimes; and current industry conditions, laws and regulations continuing in effect (or, where changes are proposed, such changes being adopted as anticipated). Readers are cautioned that such assumptions, although considered reasonable by Petro Victory at the time of preparation, may prove to be incorrect.

Actual results achieved will vary from the information provided herein as a result of numerous known and unknown risks and uncertainties and other factors.

The above summary of assumptions and risks related to forward-looking statements in this press release has been provided in order to provide shareholders and potential investors with a more complete perspective on Petro Victory's current and future operations, and such information may not be appropriate for other purposes. There is no representation by Petro Victory that actual results achieved will be the same in whole or in part as those referenced in the forward-looking statements, and Petro Victory does not undertake any obligation

to update publicly or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by applicable securities law.

Oil and Natural Gas Reserves

The disclosure in this news release summarizes certain information contained in the GLJ Reserves and Resources Report but represents only a portion of the disclosure required under National Instrument 51-101 ("NI 51-101"). Full disclosure with respect to the Company's reserves as at December 31, 2023 is contained in the Company's Form 51-101F1 for the year ended December 31, 2023 which has been filed on SEDAR+ (www.sedarplus.com) as part of the Annual Information Form. All net present values in this press release are based on estimates of future operating and capital costs and GLJ's forecast prices as of December 31, 2023 and have been made assuming the development of each property in respect of which the estimate is made will occur, without regard to the likely availability to the reporting issuer of funding required for that development. The reserves and resource definitions used in this evaluation are the standards defined by the Canadian Oil and Gas Evaluation Handbook (COGEH) reserve definitions, are consistent with NI 51-101 and are used by GLJ. The net present values of future net revenue attributable to the Petro Victory's reserves and resources estimated by GLJ do not represent the fair market value of those reserves. Other assumptions and qualifications relating to costs, prices for future production, and other matters are summarized herein. The Company's reserves volumes and the contingent resource volumes should not be read as a combined total due to the different levels of uncertainty and inherent risks associated with both classifications of recoverable volumes. The recovery and reserve estimates of the Company's reserves and resources provided herein are estimates only, and there is no guarantee that the estimated reserves will be recovered. Actual reserves and resources may be greater than or less than the estimates provided herein. Possible reserves are those additional reserves that are less certain to be recovered than probable reserves. There is a 10% probability that the quantities actually recovered will equal or exceed the sum of proved plus probable plus possible reserves.

With respect to the development pending risked contingent resources, there can be no certainty that the project will be developed on the timelines outlined within reserve and resource report. There is uncertainty that it will be commercially viable to produce any portion of the resources. The development of the project is dependent on several contingencies as described. Significant positive factors relevant to the estimate include existing test logs of the gas in the field and corporate commitment to the project. Significant negative factors relevant to the estimate include the economic viability of the project (with sensitivity to low commodity prices), access to commitment from future partners and/or amount of capital required to develop resources at an acceptable cost, and regulatory approvals for planned activities including stimulations and new infrastructure developments.

BOE Disclosure

The term BARRELS OF OIL EQUIVALENT ("boe") may be misleading, particularly if used in isolation. A boe conversion ratio of six thousand cubic feet per barrel (6 Mcf/bbl.) of natural gas to barrels of oil equivalence is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. All boe conversions in this news release are derived from converting gas to oil in the ratio mix of six thousand cubic feet of gas to one barrel of oil.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/petro-victory-energy-corp-provides-operations-update-302238726.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/petro-victory-energy-corp-provides-operations-update-302238726.html

SOURCE Petro-Victory Energy Corp.